MPI’s Exclusive Partner for Payment Acceptance Solutions

and Cloud-Based A/R Technology

New Benefit for Members: Automated Accounts Receivable Technology

Meeting Professionals International has partnered with Unified Payments Group to help you increase margins and accelerate cashflow. You now have access to industry-leading A/R and payment acceptance technology which streamline e-Commerce and your entire A/R workflow, from invoicing to payment reconciliation.

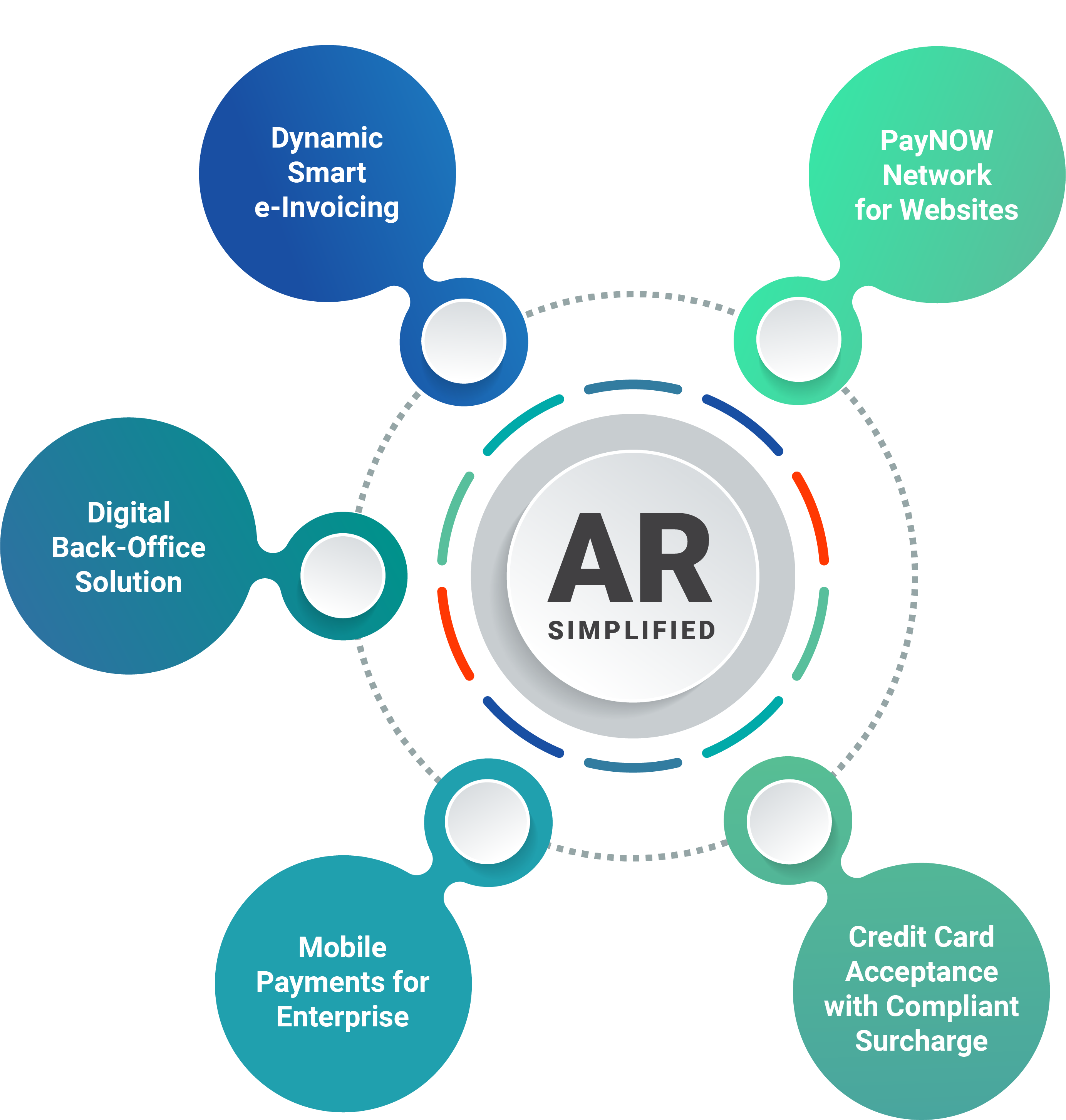

Unified Payments’ technology and their team of experts are ready to help you reduce A/R costs, accelerate cashflow and replace outdated paper workflows with easy to use, cloud-based solutions, including:

Make Getting Paid Easy with A/R and Cash Application Solutions

from Unified Payments Group.

Stop mailing invoices, waiting for customers’ checks, and paying processing fees to accept credit cards. See how Unified simplifies the entire AR process and makes getting paid easy in this 2-minute video.

ACCOUNTS RECEIVABLE SIMPLIFIED

“Our StandOut Marketing Strategies business has saved significant money with Unified’s 0% cost credit card acceptance solution. We no longer pay transaction-processing fees when customers pay with credit cards. Plus, our Unified Payment gateway means our customers can pay online rather than by check. I’m on a first-name basis with my Unified Account Manager! He understands our business and is proactive in helping us find ways to save money and get paid faster. I couldn’t be more satisfied with the level of support we receive, regardless of the hour. Unified makes us feel like we’re their number one client, and that’s why I’ve already recommended them to others in the Promotional Marketing Industry. Unified earned that. They’re nice people, too.”

Gaye Ribble, Co-Owner and CEO

Standout Marketing Strategies

Download the case study to read more…

CLOUD-BASED ACCOUNT RECEIVABLE SOLUTIONS

FROM THE PAYMENTS PARTNER YOU CAN TRUST

Account receivable solutions from Unified integrate easily into your existing workflows and processes with minimal disruption. Our smart technology solves specific pain points to modernize your entire A/R workflow.

EASY-TO-USE TECHNOLOGY. PAYMENT EXPERTS. UNIFIED A/R

Let Unified be your Subject Matter Expert for a personalized consultation, exceptional support, and service.

- Ensure your Accounts Receivable excellence with our on-going assessment and service.

- No call-center roulette, ever. Our qualified, U.S.-based team is on standby 24/7.

- Dedicated Relationship Manager to understand and anticipate your business needs.

- One partner for all your payment needs.

Award-Winning Fintech Designed for Business Owners

Simplify your A/R process with best-in-class, integrated payment processing. Recognized as a “TOP 10 A/R and E-Invoice Solutions Provider” in 2018 and 2019 by CFO Tech Outlook Magazine, Unified helps businesses of all sizes accelerate cash flow, lower costs and generate useful business insights through robust payment and remittance data with digital solutions to A/R workflows.

COMPREHENSIVE A/R SOLUTIONS FOR YOUR BUSINESS

Unified streamlines and simplifies how you bill your customers and get paid, with digital solutions for everything from invoicing to payment reconciliation.

Download the brochure to learn more about solutions designed for business owners, and the concierge-level support that makes Unified best-in-class.

Download to read more.

B2B Accounts Receivable

Quarterly Update

Business Card Tier Restructuring and Rising Interchange Costs

We are pleased to roll out our inaugural quarterly update on all subject matters related to B2B payments. We hope to both educate and enlighten you and your team along the way.

Download to read more.

SATISFIED CLIENTS SAY

Director of Sales & Marketing, TrinDocs

“TrinDocs automates payables, including direct ships and freight, for P21 users and we are proud to work with an equally impressive partner in Unified A/R. Together, TrinDocs and Unified A/R simplify the entire Accounting process!”

Controller, Western Pacific Distributors

“Unified A/R has become WPD’s greatest tool to increase cash flow. Your Support Team is amazing!”

Founder & President, Atlas Precision Consulting

“The team at Unified A/R has built a great product and do a fantastic job supporting it. We like working with them so much we became a customer and use their solution in our Prophet 21 system. We are very happy with the results.”

President, Channel Software

“We chose to partner with Unified A/R because of the efficiencies and cost savings our shared clients have realized.”

Controller, The YES Group

“Our customers love being able to pay at night, on weekends or anytime they want with PayNOW from Unified A/R.”

Credit Manager, Auer Steel

“We improved DSO tremendously with Unified A/R! They are an incredible partner for Auer Steel and our clients.”

ARE YOU STILL PAYING FEES TO PROCESS B2B CREDIT CARD PAYMENTS?

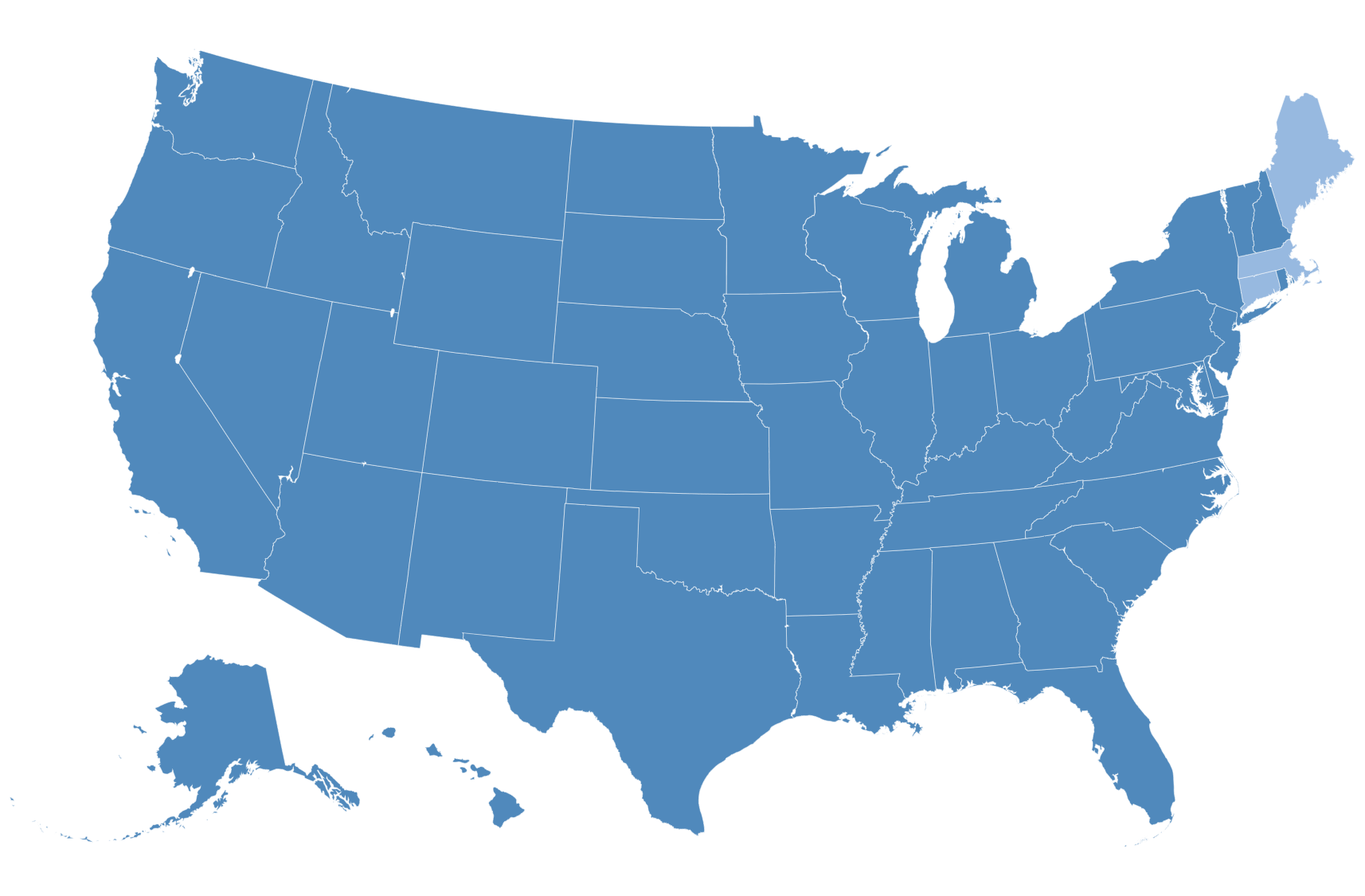

Now you can accept credit cards at 0% cost with Unified’s compliant surcharge platform for credit card acceptance. Our best-in-class surcharge solution is available the following states, so no matter where you and your customers are located, you can trust Unified to keep you compliant automatically.

PROTECT MARGINS AND REDUCE FEES.

SURCHARGE CUSTOMERS’ B2B CREDIT CARD PAYMENTS TO ACCEPT CARDS AT ZERO COST.

Advanced technology and new solutions make it possible to protect margins and now accept credit cards at true ZERO cost to your business. Unified Commerce is at the forefront of dynamic changes impacting the way businesses are paid. Our smart solutions apply surcharges on B2B credit card transactions, allowing you to pass transaction fees on to customers who choose the convenience of paying with a credit card.

SURCHARGING B2B CREDIT CARD TRANSACTION IN THREE 30-MINUTE VIDEOS.

Your schedule is full and your time is important. That’s why we’ve made zero cost credit card acceptance easy with three 30-minute videos. Learn how a successful surcharge strategy can help you protect your margins if you already accept credit cards, and can even increase your profitability if you’ve been waiting for the right time to begin accepting credit cards.

PART I: ACCEPT CREDIT CARDS AT ZERO COST.

See real-life surcharge examples, including the impact on specific wholesaler-distributors’ margins. NOTE: 2 additional states have allowed surcharging since this recording!!!

PART II: INCREASE CASH FLOW & PROFITABILITY WITH SURCHARGES.

A Federal Reserve Study confirmed that the fastest growing payment type is credit card. Learn how to leverage this trend to grow revenue, increase sales and cashflow, and strengthen customer loyalty.

PART III: HOW TO IMPLEMENT YOUR SURCHARGE PROGRAM.

Find out how to calculate and unlock savings, stay compliant, and communicate surcharges to customers with a strategic go-to-market plan and no upfront costs.