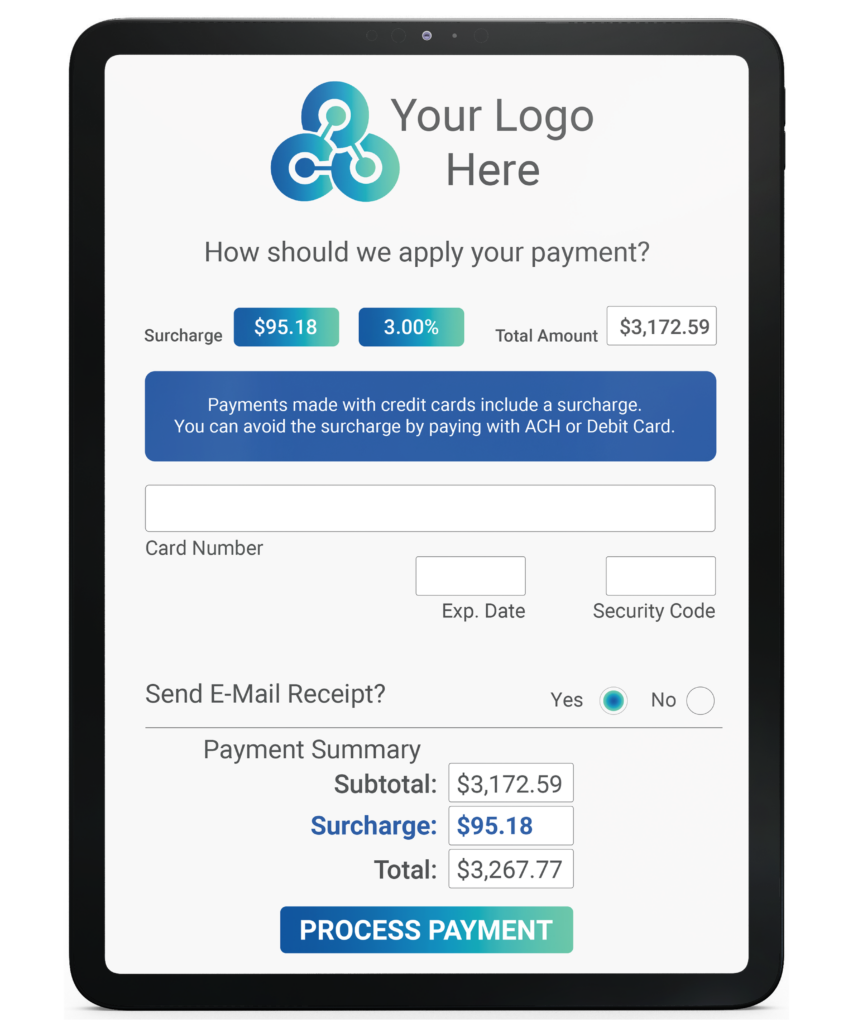

Unified A/R’s best-in-class credit card acceptance solutions automate surcharges on B2B card payments with cloud-based technology that keeps you compliant. Card processing fees are automatically passed to your clients who choose the convenience of paying with credit cards. At point of sale (POS), your customers are notified of the surcharge and automatically presented the option to switch to no-fee payment methods.

Protect Margins With Automated, Compliant Surcharges on Clients’ Credit Card Payments.

Recent rulings at Federal and State levels allow surcharges on B2B credit card payments to cover transaction costs, however, there are requirements that must be met. Unified A/R’s technology automates the surcharge so you never have to calculate credit card processing fees.

Safe, Secure and PCI-Compliant

Unified A/R leverages state-of-art data security measures and protocols to protect your data and your customers’ information. Our cloud-based technology includes fraud management tools and algorithms which adapt in real-time to identify fraud attempts. Rules and filters detect suspicious activity so transactions can be declined/approved pre and post authorization, simply and efficiently on a single dashboard.

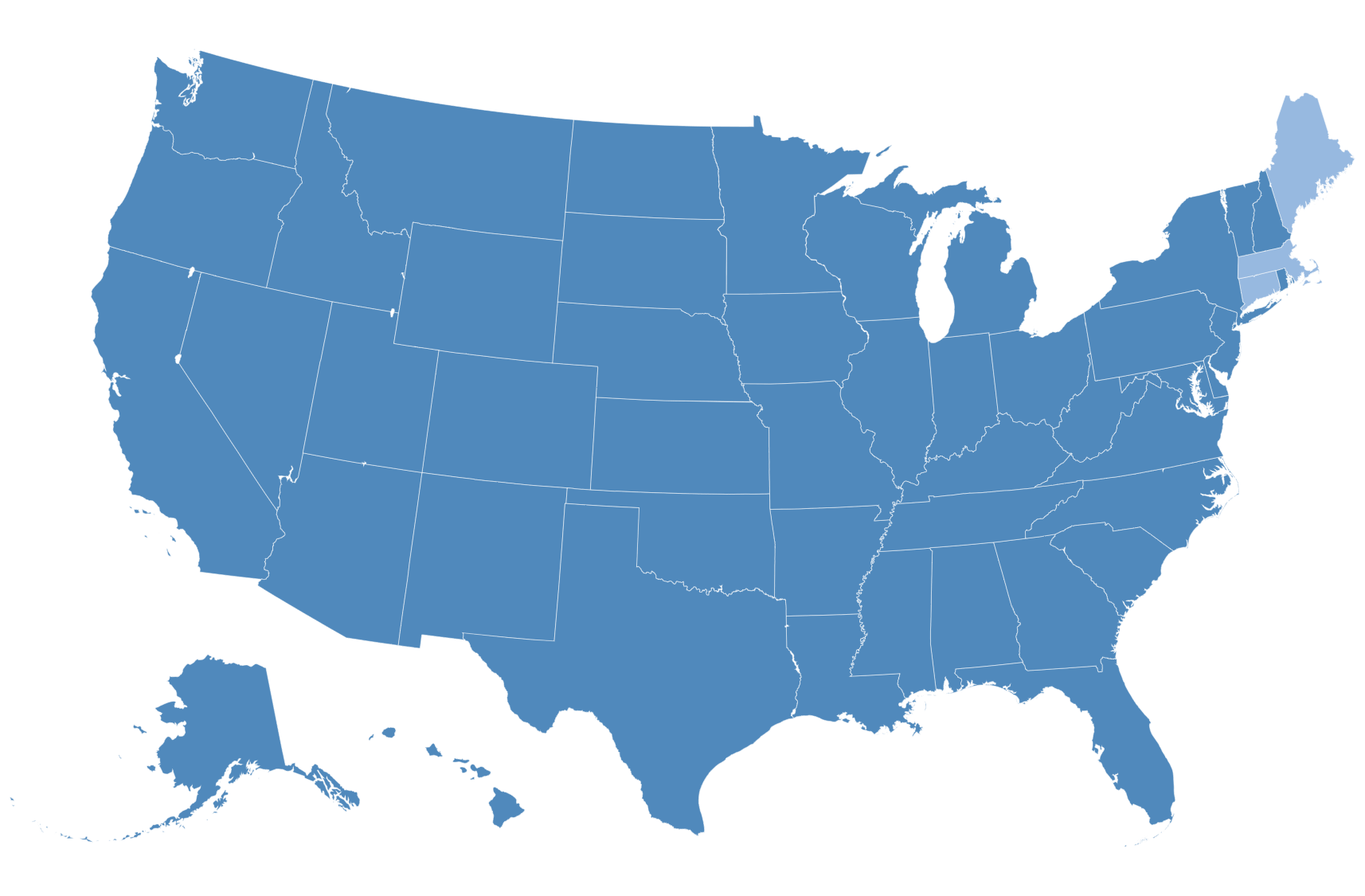

Compliant Surcharge Automation for Your Business

We’re the experts and we’re sharing our knowledge by offering smart technology that evolves and updates in real-time, so you don’t have to think about how to calculate fees. Our best-in-class surcharge solution is available in the following states, so no matter where you and your customers are located, you can trust Unified A/R to keep you compliant.

Get the Surcharge Whitepaper

Request your Surcharge Whitepaper prepared for Unified A/R clients, prospects and partners.

Director of Sales & Marketing, TrinDocs

“TrinDocs automates payables, including direct ships and freight, for P21 users and we are proud to work with an equally impressive partner in Unified A/R. Together, TrinDocs and Unified A/R simplify the entire Accounting process!”

Controller, Western Pacific Distributors

“Unified A/R has become WPD’s greatest tool to increase cash flow. Your Support Team is amazing!”

Founder & President, Atlas Precision Consulting

“The team at Unified A/R has built a great product and do a fantastic job supporting it. We like working with them so much we became a customer and use their solution in our Prophet 21 system. We are very happy with the results.”

President, Channel Software

“We chose to partner with Unified A/R because of the efficiencies and cost savings our shared clients have realized.”

Controller, The YES Group

“Our customers love being able to pay at night, on weekends or anytime they want with PayNOW from Unified A/R.”

Credit Manager, Auer Steel

“We improved DSO tremendously with Unified A/R! They are an incredible partner for Auer Steel and our clients.”

President, Rubber Tree Systems

“By combining our sales tools and business intelligence with Unified A/R’s expertise, we are providing a comprehensive and complementary solution that simplifies daily operations for manufacturers and industrial distributors.”

VP of Internal Operations, M&M Sales & Equipment

“Implementation was seamless and we were active on the go-live date! We’ve had very few implementations that were this easy.”

Credit Manager, NDI Office Furniture

“We love Unified A/R! They made it a very easy and smooth process for our customers and the payments they send.”

Accounting Controller, KATO-CES

“Unified A/R is very user-friendly. We haven’t had any problems. We love it!”

“I’m always looking for ways to help my clients. Unified A/R accomplishes that with a seamless integration for B2B accounts receivable. Unified A/R is best in class. The technology is outstanding and their Implementation & Support Teams are phenomenal.”

“I don’t recommend lightly, but I recommend Unified A/R to all of my customers. A phenomenal company with superior technology. Unified A/R is the perfect package.”

“We partnered with Unified A/R because their technology is best-in-class and brings tremendous value to the P21-user community. Not only do they operate with the highest level of integrity, but customer response and customer return on investment to their teams’ services has been stellar.”

“Unified A/R provides an incredibly robust solution backed by a very capable and responsive team. Their platform was easy to integrate and quick to deploy.”

“We recommend Unified’s A/R Automation for P21 to all of our clients. Unified brings significant savings and efficiencies to wholesaler-distributors.”

“We’ve seen huge savings and efficiencies since partnering with Unified A/R. Implementation was quick and easy. Unified is extremely responsive when we have questions.”

“If you want to reduce your credit card fees or free up time for your team to work on more important items without a lot of capital outlay, Unified A/R is a no-brainer. Why wouldn’t you try it?”

“Integrating least-cost payment routing technology, including automated surcharge on credit card processing and ACH payment acceptance, into Salesforce created savings immediately. We’re extremely satisfied with how intuitive to use and easy to implement Unified’s A/R and payment acceptance solutions have been.”

“In just days, our customers had already made dozens of payments online and we saw real savings immediately. The implementation was excellent and the support team was really on top of things. We felt like we were their number one client and are looking forward to expanding the relationship with more of Unified’s A/R solutions.”

“Our team loves working with Unified A/R. After putting Unified A/R in place, our back office saved 30% of their time, which we were able to transition to other duties.”

“We trust Unified A/R because of their more than two decades of experience working with NAW to educate and provide solutions to wholesaler-distributors. Unified A/R’s smart solutions and best-in-class technology combined with unparalleled support and integrity are why NAW is a Unified A/R customer and why we recommend them to wholesaler-distributors.”

“Unified A/R reduced our payment transaction fees by 54%. Our new secure payment gateway consolidates all of our payment types, eliminates the need for credit card terminals, and easily emails digital invoices which has reduced our DSO.”

Book Your A/R Automation Demo

and Receive Your Complimentary Surcharge Savings Analysis and A/R Consultation